Wall Street Has Claimed Bitcoin — But Is Digital Gold Still a Hedge?

Lead

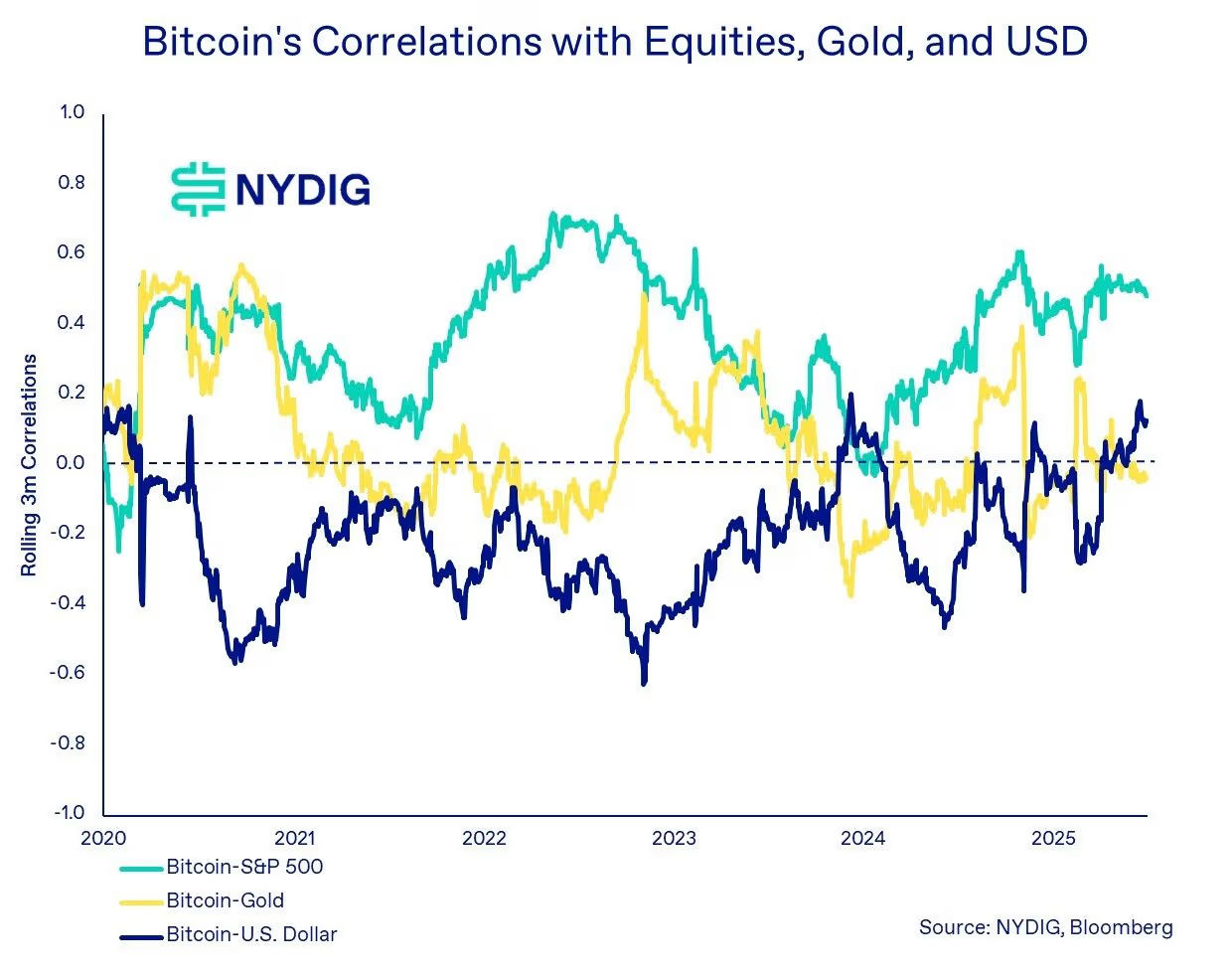

This week’s chart reveals a seismic shift: bitcoin’s correlation with U.S. equities has surged, dragging it deeper into traditional market dynamics. Once celebrated as anti‑establishment, bitcoin increasingly behaves like a macro‑driven risk asset.

1. From Rebel Asset to Institutional Client

Bitcoin, once prized as a hedge and “digital gold,” now moves in sync with stock markets. NYDIG data shows bitcoin’s correlation with U.S. equities at approximately 0.48—near the top of its historical range. By contrast, its ties to gold and the U.S. dollar hover near zero .

2. Why This Matters

A correlation near 0.5 means bitcoin no longer offers the diversification it once promised. As equities rise or fall, bitcoin’s price swings mirror the same macro forces: monetary policy shifts, geopolitical shocks, interest rate pivots, and global trade tensions .

3. Inside the Chart

The featured chart vividly displays bitcoin’s rising synchronicity with the S&P 500, even as its link to gold and the dollar remains limp . This effectively turns bitcoin into another stock ticker in portfolios.

4. What This Means for Investors

- Short/medium term: Expect bitcoin to behave like a macro play—sensitive to Fed announcements, inflation data, and global risk aversion.

- Long term: Enthusiasts still celebrate bitcoin’s fixed supply, decentralization, and inflation-resistant design. But those traits don’t currently drive price in daily trade.

5. What Comes Next?

If traditional markets take a hit, bitcoin likely will too. For now, it’s no safe haven—if Wall Street sneezes, bitcoin catches a cold. The chart suggests this correlation regime may persist amid ongoing economic uncertainty.

Bottom Line:

Bitcoin has largely shed its outsider status and is now embedded within traditional asset classes. Investors seeking uncorrelated exposure or digital gold must rethink their strategies. Going forward, treat bitcoin like a risk asset pegged to macro trends, not as a hedge against them.